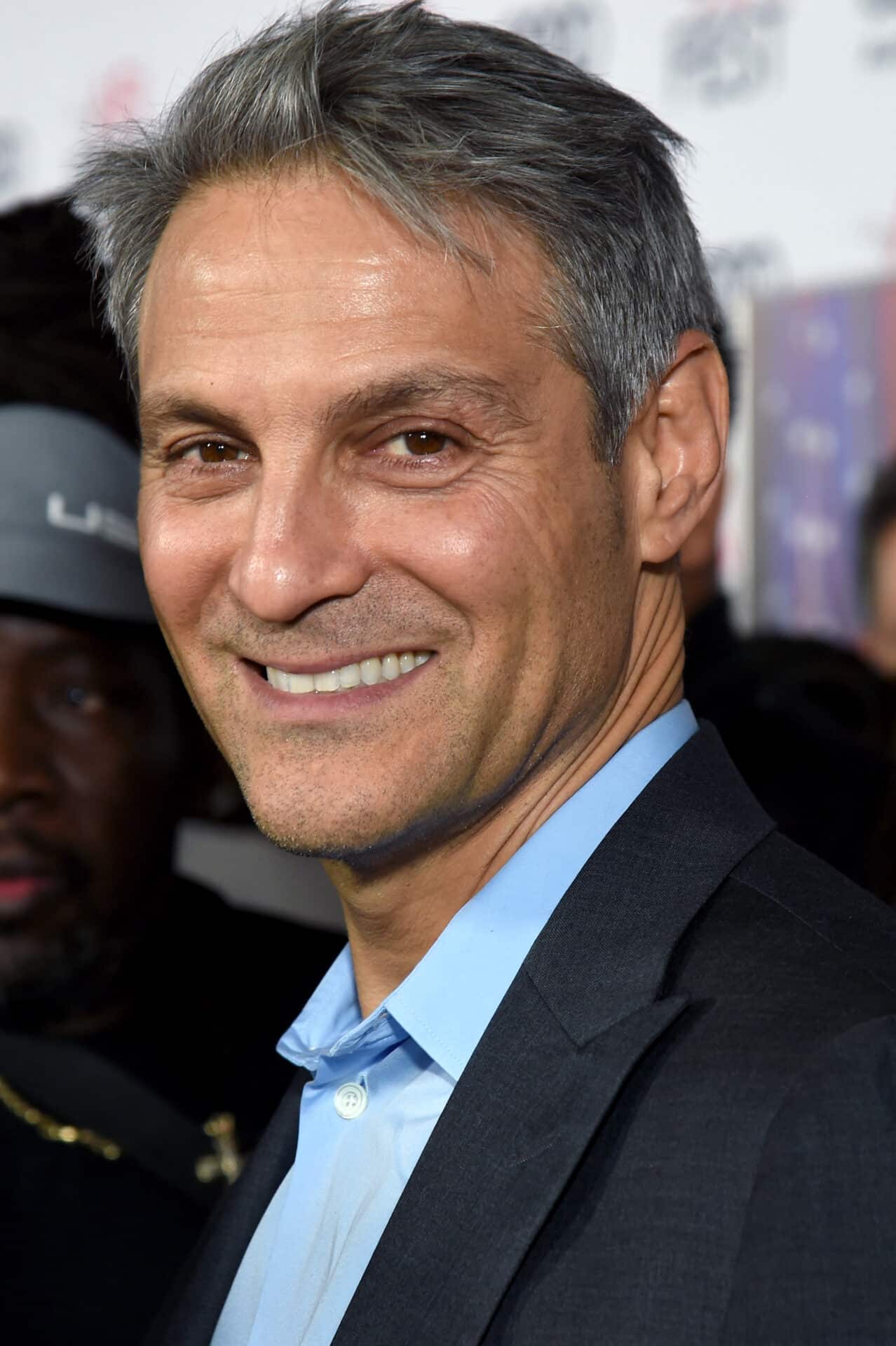

Ari Emanuel

CEO | Endeavor

(Getty Images)

Content is king, and talent agencies are the brokers of that content. Consumer trends can be fickle, but storied brands, household names and diversification are part of that equation, which WME head Ari Emanuel seems to understand all too well.

“The creation of TKO marks an exciting new chapter for UFC and WWE as leaders in global sports and entertainment,” said Ariel Emanuel, CEO of Endeavor and the newly formed, publicly traded TKO. The formation, which merges the two sports franchises, follows Endeavor’s $9.3 billion acquisition earlier this year of WWE, the pro-wrestling juggernaut that has been a staple at arenas and stadiums of all sizes for decades.

“Given their continued connectivity to the Endeavor network, we are confident in our ability to accelerate their respective growth and unlock long-term sustainable value for shareholders. With UFC and WWE under one roof, we will provide unrivaled experiences for more than a billion passionate fans worldwide,” Emanuel added.

Endeavor’s acquisition of WWE is a further example of the power — and value — of content, despite always-evolving consumer tastes, delivery methods for that content and labor issues such as the ongoing writers strike.

The household name that brings spandex to TV screens, the arena floor and sends bundles of merchandise back home further diversifies the company, which already counts among its holdings major talent agency WME, IMG, Professional Bull Riders and the EuroLeague basketball organization. Time will tell if the merged entity can keep up the loyal fanbase that has known one singular family as owner — the McMahons — for the last four decades.

TKO began trading on the New York Stock Exchange on Sept. 12, with analysts praising the opportunity for the merged entity as a prominent player in sports entertainment.

“We like the assets of UFC and WWE in a world where linear TV is losing market share to streaming, thus live sports content is in high demand,” Jefferies analyst Randal Konik wrote.

“The upcoming rights expirations for both WWE and UFC present meaningful upside opportunities to the cash flows of both UFC and WWE in their own rights and will further drive EBITDA margins in each franchise incrementally higher.” — Ryan Borba