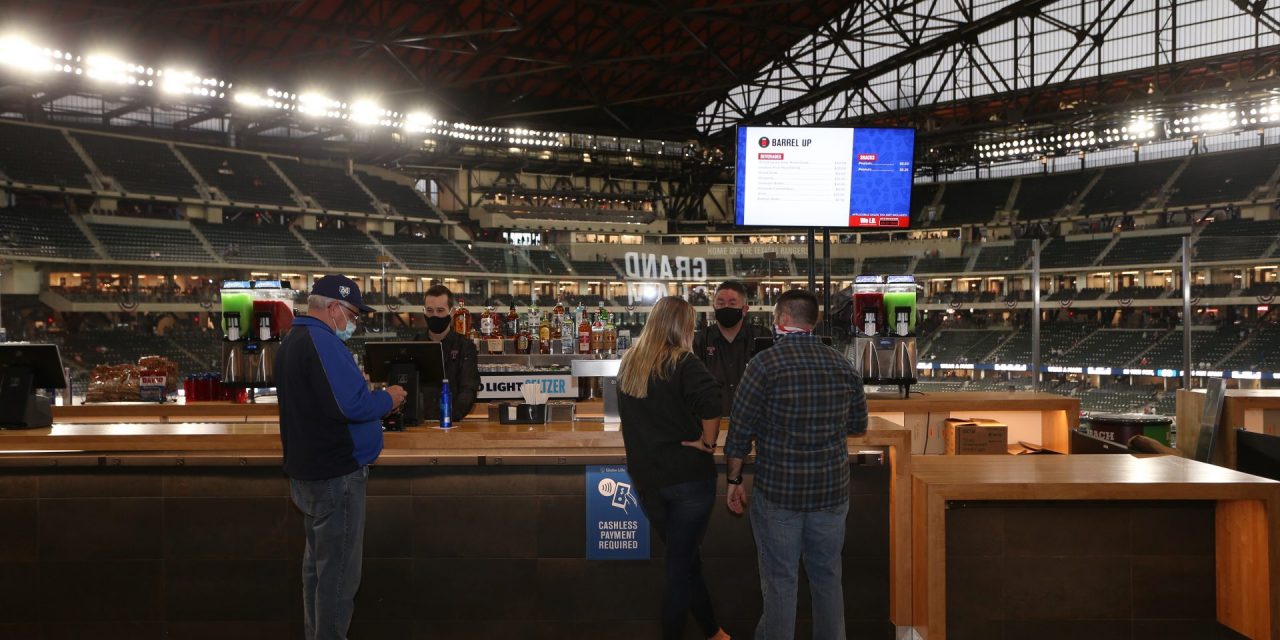

Fans buy drinks at a Globe Life Field bar during the World Series, where Delaware North Sportservice added sales tax on top of the listed price. (Courtesy Texas Rangers) With cashless, tax now more often tacked on to listed price The shift to cashless concessions at sports venues has multiple benefits for teams, vendors and fans, but one byproduct has gone under the radar — the sales tax applied to the sale of hot dogs, beer and other items. The way the tax is being treated as part of an all-cashless environment is generating additional revenue for teams and concessionaires, although it’s effectively increasing what fans pay for concessions, even with the much ballyhooed fan-friendly pricing model at Mercedes-Benz Stadium. During the pandemic, teams and their third-party providers have accelerated the transition for accepting credit and debit cards to pay for food, drink and merchandise by eliminating cash payments altogether. … Continue Reading New Concessions Add-On: Sales Tax

New Concessions Add-On: Sales Tax